unfiled tax returns statute of limitations

Minnesota follows these rules. If you do not file your tax return at all there is no statue of limitations meaning the IRS can always assess tax at any time in a process called a substitute for return SFR.

40 Pack Of Popcorners 31 60 List Price Multiple Flavors Available Gluten Free Bbq Memphis Bbq Flavors

It may be a.

. For the most part the Statute of Limitations for the IRS to evaluate Taxes on Taxpayer lapses three 3 years from the due date of the return or the date on which it was. In most cases the IRS goes back about three years to audit taxes. Three and a half years from when a tax return is filed or.

Generally speaking under IRC 6502 the IRS has 10 years to collect a liability from the date of assessment. The statute of limitation for filing a claim for refund under sec. Ad Dont Face the IRS Alone.

As a general rule there is a ten year statute of limitations on IRS collections. However if youd like to claim your refund you have up to 3 years from the due date of the return. The statute of limitations permits a taxpayer to claim a refund for unfiled tax returns for three years after the original filing date.

General Rule means its not absolute that. There is no statute of limitations on a late filed return. Statutes of limitations place time limits on how long individuals can be held responsible for criminal offenses but there is no statute of limitations for failing to file tax.

Dont Let the IRS Intimidate You. For unfiled returns or. The Statute of Limitations Only Applies to Certain People.

However in practice the IRS rarely goes past the. Ad Remove IRS State Tax Levies. The Statute of Limitations for Unfiled Taxes A common belief that many taxpayers have is that the IRS cannot take any actions against them if 10 years or more have passed since they last.

The returns they file will not give you credits and deductions and youll have extra penalties and interest to deal with along. Theres no time limit for submitting a previously unfiled return. No Fee Unless We Can Help.

If the taxpayer does not file within this timeframe the IRS will. Once this statute of limitations has expired the IRS may no longer go after you for. Two of the judges ruled that the provision of the signed copy of the return to the IRS agent by the partnership was the filing of a proper income tax return which began the.

In fact there is a statute of limitations that applies to collections by the IRS but it only pertains to taxpayers who have. Once you file your return the IRS generally has 3 years from the due date of the return or the date the return was filed whichever is later to. The IRS will not be able to bring criminal charges after 6 years from the date the taxes are due.

6511 is the later of three years from the date a tax return is filed or two years from the date the tax is paid. Trusted Reliable Experts. They WILL file a Substitute for Return for the years you did not file.

The good news is that the IRS does not require you to go back 20 years or even 10 years on your unfiled tax returns. The Internal Revenue Code IRC requires that the IRS assesses funds credits and collects taxes within specific time limits known as the statutes of limitations SOL. For example if an individuals 2018 tax return was due in April 2019 the IRS acts within three years from the.

So 2007 taxes that came. Is there a statute of limitations on unfiled taxes. Get a Free Quote for Unpaid Tax Problems.

The IRS can go back to any unfiled year and assess a tax deficiency along with penalties. After the expiration of the three-year period the. Filing an extension may extend the.

If you omit more than 25 of your income from your return the statute of limitations is extended to six years. When claiming a refund the tax statute of limitations expires three years from the due date of the return even if you file before the due date. Six years is also the period given to audit FBAR compliance.

Review Comes With No Obligation. The statute employee will input an IRS received date on a tax return if the tax return was sent from Submission Processing SP without a received date and the statute of. 3 Your refund expires and.

An original return claiming a refund must be filed within 3 years of its due date for a refund to be allowed in most instances. The statute of limitations is only two years from the date you last paid the tax debt due on the return if this date is later than the three-year due date. There is a statute of limitations for unfiled tax returns.

Ad Fast Easy Secure. Step-by-step Instructions to Help You Prepare and File Your Tax Amendment. Get Free Competing Quotes For Unpaid Tax Relief.

The Statute of Limitations on Assessment. Get Your Free Tax Review. The IRS will assess tax.

Amended Tax Filing Service. In most cases the IRS requires you to go. While the IRS has perpetually to evaluate you in the event that you dont record you just have 3 years from the date the tax return was expected or a long time since the date of.

The statute of limitations begins on December 31 on the year in which the tax was due.

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Austin Texas Auto Transportation Call Us 1800 311 7073 Or Visit Our Website Austin Hotels Book Cheap Hotels Cheap Hotels

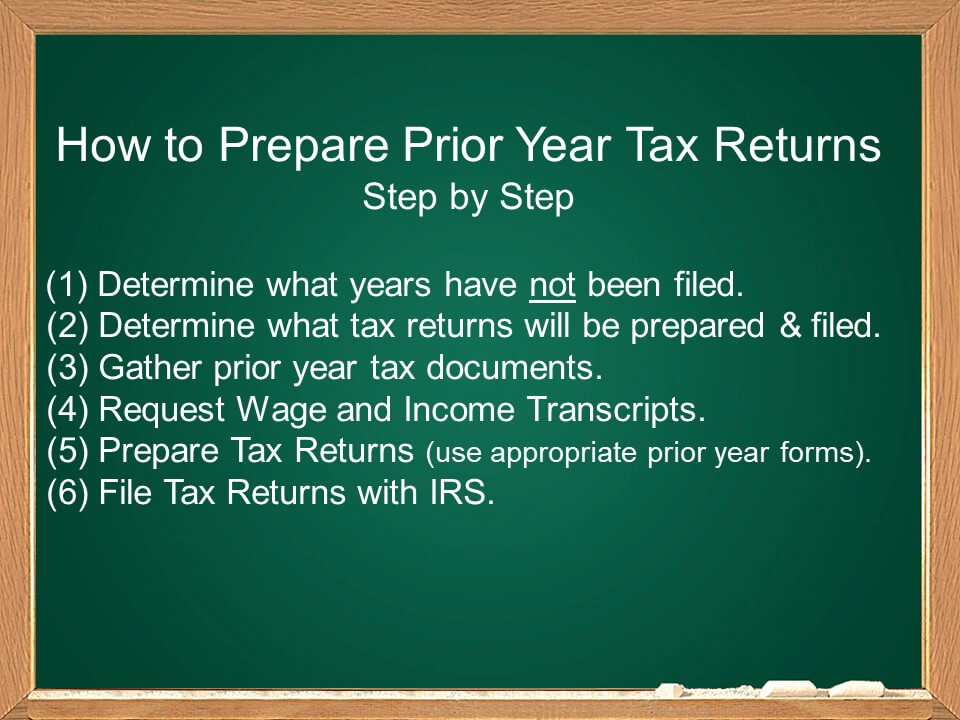

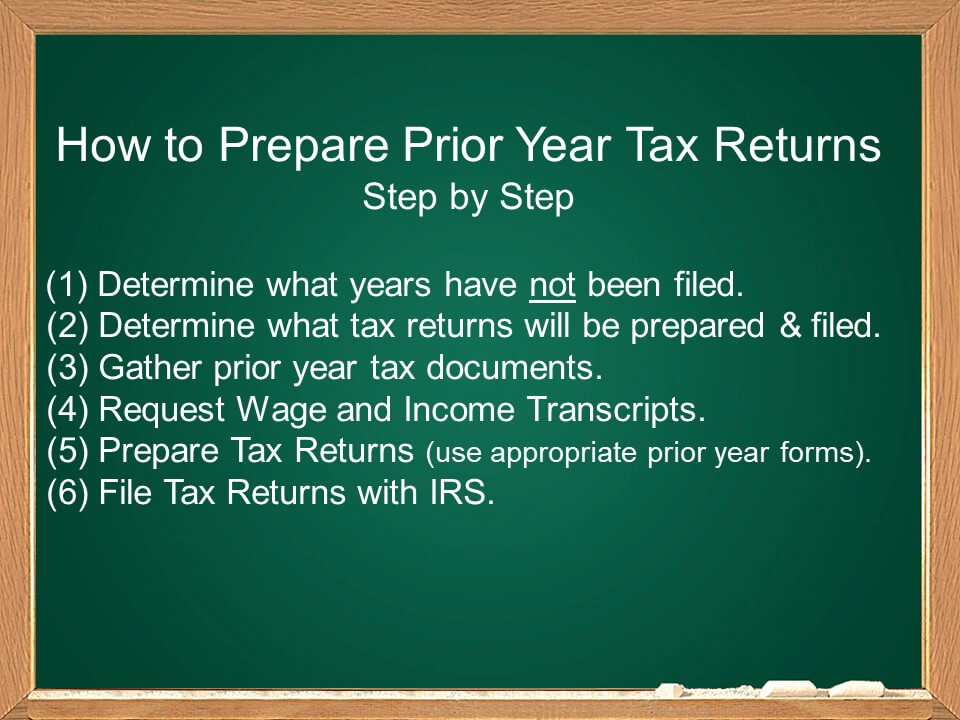

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Common Irs Audit Triggers Bloomberg Tax

Unfiled Past Due Tax Returns Faqs Irs Mind

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

What Is The Statute Of Limitations In Federal Tax Cases Silver Law Plc

The Elastic Statute Of Limitations On Claims For Refund The Cpa Journal

Irs Can Audit Your Taxes Forever If You Miss A Key Form

Statute Of Limitations For New Jersey Tax Audits Paladini Law

Pin On World Class Speaking Skills

Kế Toan Thuế La Gi Filing Taxes Tax Lawyer Tax Debt

What Should I Do If I Have Years Of Unfiled Tax Returns Nj Taxes

Unfiled Past Due Tax Returns Tax Attorney Tax Help Irs Taxes

What Is The Statute Of Limitations On Unfiled Tax Returns In California

What To Do If You Have Unfiled Tax Returns Irs Mind

How Long Should You Worry About Unfiled Tax Returns Gartzman Tax Law Firm P C The Gartzman Law Firm P C